Latest News

Via Benzinga · January 20, 2026

Via MarketBeat · January 20, 2026

The tech sector hasn't hit a new all-time high in four months. When 30% of the S&P 500 can't make a new high, the index has a serious problem.

Via Talk Markets · January 20, 2026

Anaergia S.r.l. starting activities for additional C$25 million in Contracts for Two Projects in Spainstocktwits.com

Via Stocktwits · January 20, 2026

The U.S. labor market has kicked off 2026 with a surprising display of fortitude. According to the latest data released by the Department of Labor on January 15, 2026, initial unemployment claims fell to 198,000 for the week ending January 10. This figure came in well below the

Via MarketMinute · January 20, 2026

UAL Shares Rise After Hours On Upbeat Guidance, Q4 Earnings Beatstocktwits.com

Via Stocktwits · January 20, 2026

As the calendar turns to early 2026, the narrative of the American banking sector has shifted from one of survival to one of strategic expansion. On January 20, 2026, US Bancorp (NYSE: USB) reported a decisive earnings beat that has set a buoyant tone for the regional banking industry, signaling

Via MarketMinute · January 20, 2026

On Jan. 20, 2026, Trump's Greenland-linked tariff threats rattled megacap tech as geopolitics, not earnings, drove Wall Street's pullback.

Via The Motley Fool · January 20, 2026

As The Charles Schwab Corporation (NYSE: SCHW) prepares to release its final Q4 2025 earnings results tomorrow, January 21, 2026, the financial community is already celebrating what appears to be the most significant turnaround in the company’s recent history. After two years of navigating the treacherous "cash sorting" phenomenon

Via MarketMinute · January 20, 2026

Serve Robotics has agreed to acquire Diligent Robotics, a maker of robot assistants for the health care industry.

Via Investor's Business Daily · January 20, 2026

As the global financial markets navigate the opening weeks of 2026, a massive structural shift has taken hold of the commodities sector. Industrial and precious metals are currently undergoing a historic price surge, with gold, silver, and copper all testing psychological and technical ceilings that were once thought unreachable. This

Via MarketMinute · January 20, 2026

GameStop rallies in Tuesday's extended trading after CEO Ryan Cohen discloses a massive purchase of the stock.

Via Benzinga · January 20, 2026

As the third week of January 2026 draws to a close, the financial landscape is witnessing a profound structural shift that many analysts are calling "The Great Realignment." After two years of nearly unrivaled dominance by Silicon Valley’s elite, the momentum that once fueled the high-flying Technology sector has

Via MarketMinute · January 20, 2026

Via Benzinga · January 20, 2026

In a decisive move that signals the government's refusal to back down from its multi-year pursuit of Big Tech, the Federal Trade Commission (FTC) officially filed a notice of appeal today, January 20, 2026. The appeal seeks to overturn a November 2025 district court ruling that had initially cleared Meta

Via MarketMinute · January 20, 2026

Via Benzinga · January 20, 2026

A global healthcare giant wants to acquire the biotech's promising development program.

Via The Motley Fool · January 20, 2026

It's not a given that owning a home is your best bet.

Via The Motley Fool · January 20, 2026

Via Benzinga · January 20, 2026

It's the most wonderful time of the year. No, not the holdiays. We're talking about making stock investing predictions for 2026. This week, the Fools each give their 2026 hot takes on specific parts of the stock market along with three stocks on their radar

Via The Motley Fool · January 20, 2026

As the clock ticks toward the end of January 2026, Wall Street is laser-focused on a single number: the Personal Consumption Expenditures (PCE) price index. With the current date of January 20, 2026, the financial world is bracing for a critical update that has been complicated by recent government administrative

Via MarketMinute · January 20, 2026

Signs that the governments are really concerned about the supply of silver and other critical minerals, and about to pump massive amounts of money in the sector continue to build.

Via Talk Markets · January 20, 2026

As the global financial community turns its attention to the fast-approaching release of the February ADP National Employment Report, the stakes for the Federal Reserve’s monetary policy have rarely been higher. Following a volatile finish to 2025 and a strategic pause in the central bank's rate-cutting cycle in January,

Via MarketMinute · January 20, 2026

Crypto Stocks Take A Beating As Bitcoin Falls Under $90,000 Mark Amid Renewed Tariff Threatsstocktwits.com

Via Stocktwits · January 20, 2026

Investors would have lost money in that time.

Via The Motley Fool · January 20, 2026

The long-standing wall between the White House and the Federal Reserve has been breached as of January 20, 2026, following an unprecedented criminal investigation launched by the Department of Justice (DOJ) into Federal Reserve Chairman Jerome Powell. The investigation, which centers on alleged misinformation regarding a $2.5 billion renovation

Via MarketMinute · January 20, 2026

The global financial landscape was upended this weekend as the Trump administration unveiled a radical new trade offensive, dubbed the “Greenland Tax,” aimed at coercing the Kingdom of Denmark into negotiating the sale of the world's largest island. In a surprise announcement on Saturday, January 17, 2026, President Trump declared

Via MarketMinute · January 20, 2026

In a historic display of financial gravity, BlackRock (NYSE: BLK) has officially crossed the $14 trillion mark in assets under management (AUM), solidifying its position as the undisputed heavyweight champion of the global investment landscape. According to its Q4 2025 earnings report released on January 15, 2026, the firm ended

Via MarketMinute · January 20, 2026

Taiwan Semiconductor Manufacturing Company (NYSE: TSM), the world’s largest contract chipmaker, has sent a powerful signal to global markets, shattering growth expectations with a bullish 2026 guidance fueled by what leadership describes as "voracious" and "insatiable" demand for Artificial Intelligence (AI) chips. In its January 15, 2026, earnings report,

Via MarketMinute · January 20, 2026

On January 15, 2026, Morgan Stanley (NYSE: MS) released a blockbuster fourth-quarter and full-year 2025 earnings report that has sent a clear message to Wall Street: the firm’s decade-long pivot toward wealth management has created a virtually impenetrable "compounding machine." By successfully balancing the high-octane, often volatile world of

Via MarketMinute · January 20, 2026

Kraft Heinz shares are sliding in Tuesday's after-hours session after Berkshire Hathaway filed to sell up to 325 million shares.

Via Benzinga · January 20, 2026

Via Benzinga · January 20, 2026

As the sun rose over Manhattan on January 20, 2026, the financial district found itself navigating a paradoxical landscape of geopolitical tension and unprecedented corporate consolidation. Goldman Sachs (NYSE: GS), the storied titan of investment banking, has effectively declared the "dealmaking winter" over, posting a blockbuster fourth-quarter and full-year 2025

Via MarketMinute · January 20, 2026

Which of these stablecoins has a brighter future?

Via The Motley Fool · January 20, 2026

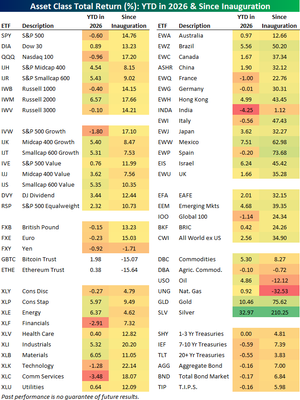

It has been one year since President Trump was sworn in for a second time. Looking back on the past year, the single best performing assets were precious metals with gold up 75.6% and silver providing an astounding 210.6% total return.

Via Talk Markets · January 20, 2026

As of January 20, 2026, the consumer staples landscape is witnessing a pivotal moment for its undisputed leader, Procter & Gamble (NYSE: PG). Just weeks after the company underwent a historic leadership transition, the market is bracing for a high-stakes second-quarter earnings report. P&G is currently navigating a complex "scissors"

Via MarketMinute · January 20, 2026

CINCINNATI — As GE Aerospace (NYSE:GE) prepares to unveil its fourth-quarter and full-year 2025 financial results on January 22, the aviation giant finds itself at a pivotal crossroads. Since its landmark spin-off in early 2024, the company has transformed into a pure-play aviation powerhouse, riding a wave of unprecedented demand

Via MarketMinute · January 20, 2026

The crowd is underpricing all three of these names, ignoring their likely futures.

Via The Motley Fool · January 20, 2026

Regional banking company Wintrust Financial (NASDAQ:WTFC) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 10.8% year on year to $714.3 million. Its non-GAAP profit of $3.15 per share was 7.5% above analysts’ consensus estimates.

Via StockStory · January 20, 2026

As the healthcare industry looks toward 2026, Johnson & Johnson (NYSE: JNJ) stands at a historic crossroads, reinforcing its reputation as the ultimate bellwether for the global healthcare sector. On the eve of its official fourth-quarter and full-year 2025 earnings release scheduled for January 21, 2026, the company has already signaled

Via MarketMinute · January 20, 2026

U.S. President Donald Trump said a White House press conference on Tuesday that he doubts the tariffs on EU countries related to Greenland would trigger them to pull back on previous investment pledges.

Via Stocktwits · January 20, 2026

CHICAGO — On January 20, 2026, United Airlines (NASDAQ: UAL) reported fourth-quarter 2025 financial results that comfortably cleared Wall Street’s hurdles, signaling a robust appetite for global travel despite a turbulent economic backdrop in late 2025. The Chicago-based carrier posted record quarterly revenue of $15.4 billion and an adjusted

Via MarketMinute · January 20, 2026

As the financial world turns its gaze toward Netflix’s (NASDAQ: NFLX) Q4 2025 earnings report this week, the conversation has shifted from simple subscriber counts to a fundamental reimagining of the media landscape. Netflix enters this reporting period not just as the "King of Streaming," but as a predatory

Via MarketMinute · January 20, 2026

The chipmaker that's seemingly not been all that interested in being in the artificial intelligence business is suddenly very interested.

Via The Motley Fool · January 20, 2026

In a bold move to transcend its identity as a legacy paper commodities giant, Kimberly-Clark (NYSE: KMB) has launched a massive $48.7 billion bid to acquire Kenvue (NYSE: KVUE), the consumer health powerhouse behind iconic brands like Tylenol and Neutrogena. The cash-and-stock deal, which represents one of the largest

Via MarketMinute · January 20, 2026

Via Benzinga · January 20, 2026

Via Benzinga · January 20, 2026