Looking back on software development stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including GitLab (NASDAQ:GTLB) and its peers.

As legendary VC investor Marc Andreessen says, "Software is eating the world", and it touches virtually every industry. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming.

The 11 software development stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.7% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 4.9% on average since the latest earnings results.

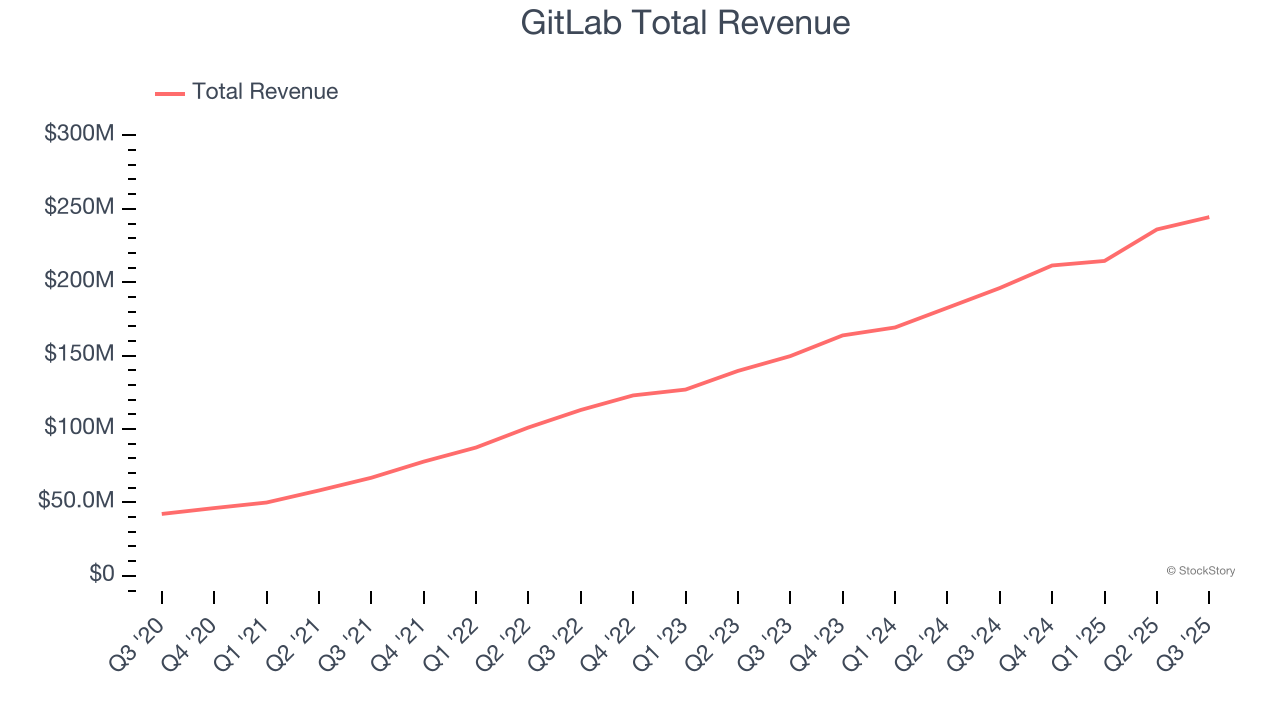

GitLab (NASDAQ:GTLB)

With its all-remote workforce pioneering a new approach to software development, GitLab (NASDAQ:GTLB) provides a single-application DevSecOps platform that helps development, operations, and security teams collaborate to build, secure, and deploy software faster.

GitLab reported revenues of $244.4 million, up 24.6% year on year. This print exceeded analysts’ expectations by 2.2%. Despite the top-line beat, it was still a mixed quarter for the company with a solid beat of analysts’ EBITDA estimates but a significant miss of analysts’ billings estimates.

The stock is down 6.3% since reporting and currently trades at $40.64.

Is now the time to buy GitLab? Access our full analysis of the earnings results here, it’s free for active Edge members.

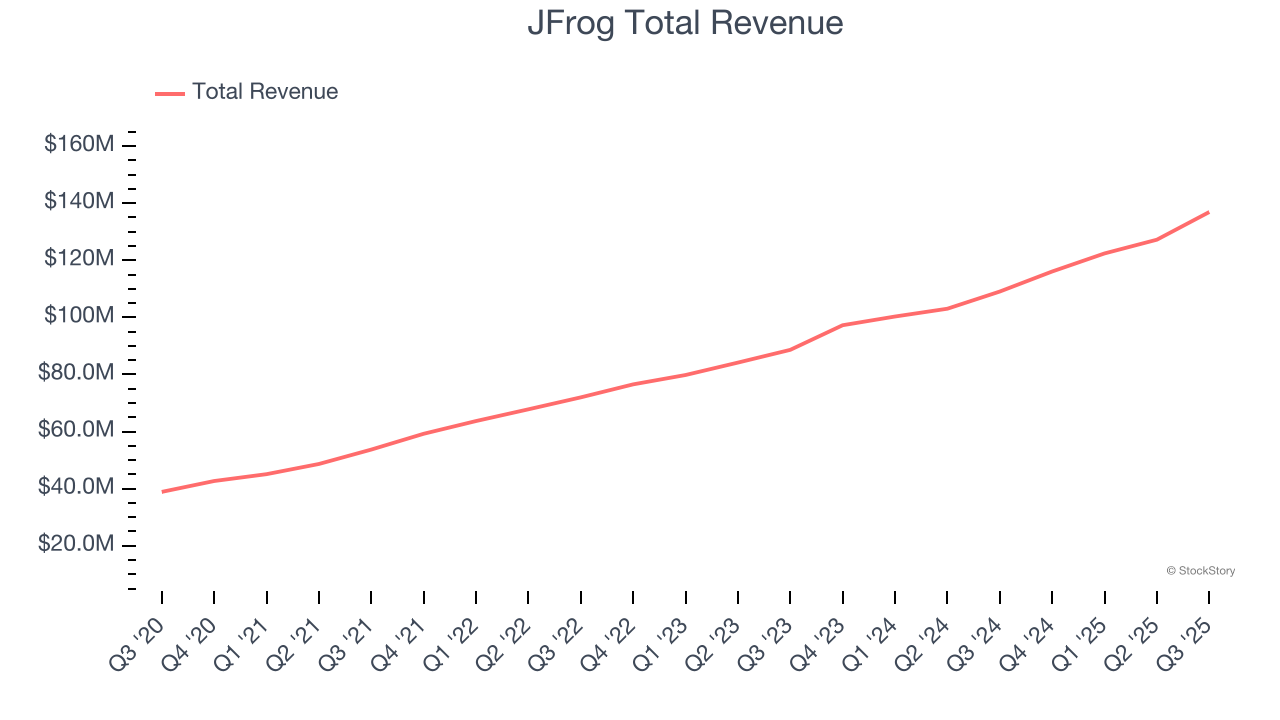

Best Q3: JFrog (NASDAQ:FROG)

Named after the amphibian that continuously evolves from egg to tadpole to adult, JFrog (NASDAQ:FROG) provides a platform that helps organizations securely create, store, manage, and distribute software packages across any system.

JFrog reported revenues of $136.9 million, up 25.5% year on year, outperforming analysts’ expectations by 6.6%. The business had an exceptional quarter with a solid beat of analysts’ billings estimates and EPS guidance for next quarter exceeding analysts’ expectations.

JFrog achieved the biggest analyst estimates beat among its peers. The company added 45 enterprise customers paying more than $100,000 annually to reach a total of 1,121. The market seems happy with the results as the stock is up 46.4% since reporting. It currently trades at $69.18.

Is now the time to buy JFrog? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: F5 (NASDAQ:FFIV)

Originally named after the F5 tornado, the most powerful on the meteorological scale, F5 (NASDAQ:FFIV) provides security and delivery solutions that protect applications across cloud, data center, and edge environments for large organizations.

F5 reported revenues of $810.1 million, up 8.5% year on year, exceeding analysts’ expectations by 2%. Still, it was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations significantly and revenue guidance for next quarter missing analysts’ expectations significantly.

As expected, the stock is down 10.3% since the results and currently trades at $260.44.

Read our full analysis of F5’s results here.

Fastly (NYSE:FSLY)

Taking its name from the core advantage it delivers to customers, Fastly (NYSE:FSLY) operates an edge cloud platform that processes, secures, and delivers web content as close to end users as possible, enabling faster digital experiences.

Fastly reported revenues of $158.2 million, up 15.3% year on year. This print surpassed analysts’ expectations by 4.7%. Overall, it was an exceptional quarter as it also put up EPS guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

Fastly had the weakest full-year guidance update among its peers. The stock is up 29.9% since reporting and currently trades at $10.49.

Read our full, actionable report on Fastly here, it’s free for active Edge members.

Datadog (NASDAQ:DDOG)

Named after a database the founders had to painstakingly look after at their previous company, Datadog (NASDAQ:DDOG) provides a software platform that helps organizations monitor and secure their cloud applications, infrastructure, and services.

Datadog reported revenues of $885.7 million, up 28.4% year on year. This number beat analysts’ expectations by 3.9%. It was an exceptional quarter as it also recorded an impressive beat of analysts’ annual recurring revenue estimates and EPS guidance for next quarter exceeding analysts’ expectations.

The company added 210 enterprise customers paying more than $100,000 annually to reach a total of 4,060. The stock is down 3.7% since reporting and currently trades at $149.79.

Read our full, actionable report on Datadog here, it’s free for active Edge members.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.