Enterprise software spending is still rising, with the global market projected to reach around $1.43 trillion in 2026, up 15.2% from the previous year. As companies invest heavily in AI, more of their IT budgets are shifting toward AI-first software, automated assistants, and specialized AI platforms. These tools aim to deliver similar results at a lower cost per user and with faster rollout times. The impact is straightforward: many established software companies that leaned on long-standing products and gradual upgrades are now facing tougher pressure on both growth and profit margins, even while overall IT spending stays healthy.

That pressure became clearer on Jan. 16, when Citi cut price targets on three major enterprise software names: Datadog (DDOG), Fastly (FSLY), and Atlassian (TEAM). The firm pointed to AI-related disruption as a key reason, along with slower customer expansion and concerns about margins. All three stocks posted strong gains in earlier years, but competition is getting tougher from both AI-focused startups and the big cloud providers. Many of those larger players are now building AI tools and automation directly into their platforms, which is forcing investors to rethink how durable these companies’ advantages really are and what their long-term earnings power looks like.

If these three software pillars are facing real disruption from AI and not just a short-term slowdown, should investors exit their positions now before the market fully prices in the size of the threat? Let’s find out.

Datadog (DDOG)

Datadog sells a cloud observability and security platform that helps enterprises monitor infrastructure, applications, logs, and user experience in one place. It has become an important tool for companies running complex systems across hybrid cloud environments and AI-heavy workloads.

DDOG is down 15% over the past 52 weeks and down 12.48% year-to-date (YTD). Even after that pullback, the valuation is still demanding.

The stock trades at a forward P/E of about 252x versus roughly 25.5x for the broader sector, which suggests investors are still paying a big premium for growth and consistency, leaving less room for mistakes.

Datadog is still putting up strong numbers, though. Q3 2025 revenue rose 28% year-over-year (YoY) to $886 million, with non-GAAP operating income of $207 million for a 23% margin and free cash flow of $214 million. Cash and marketable securities totaled $4.1 billion. Management guided Q4 2025 revenue to $912 to $916 million and full-year 2025 revenue to $3.386 to $3.390 billion, pointing to continued momentum even as AI shifts what customers expect from software platforms.

Recent partnerships include a Contrast Security integration that brings verified application runtime intelligence into Datadog Cloud SIEM to help reduce false alerts, plus an expanded strategic collaboration agreement with AWS that introduced new AI, observability, and security capabilities at AWS re:Invent. These efforts expand the product set, but they also highlight the risk that Datadog has to keep adding AI-driven capabilities fast enough to avoid getting boxed in by hyperscalers.

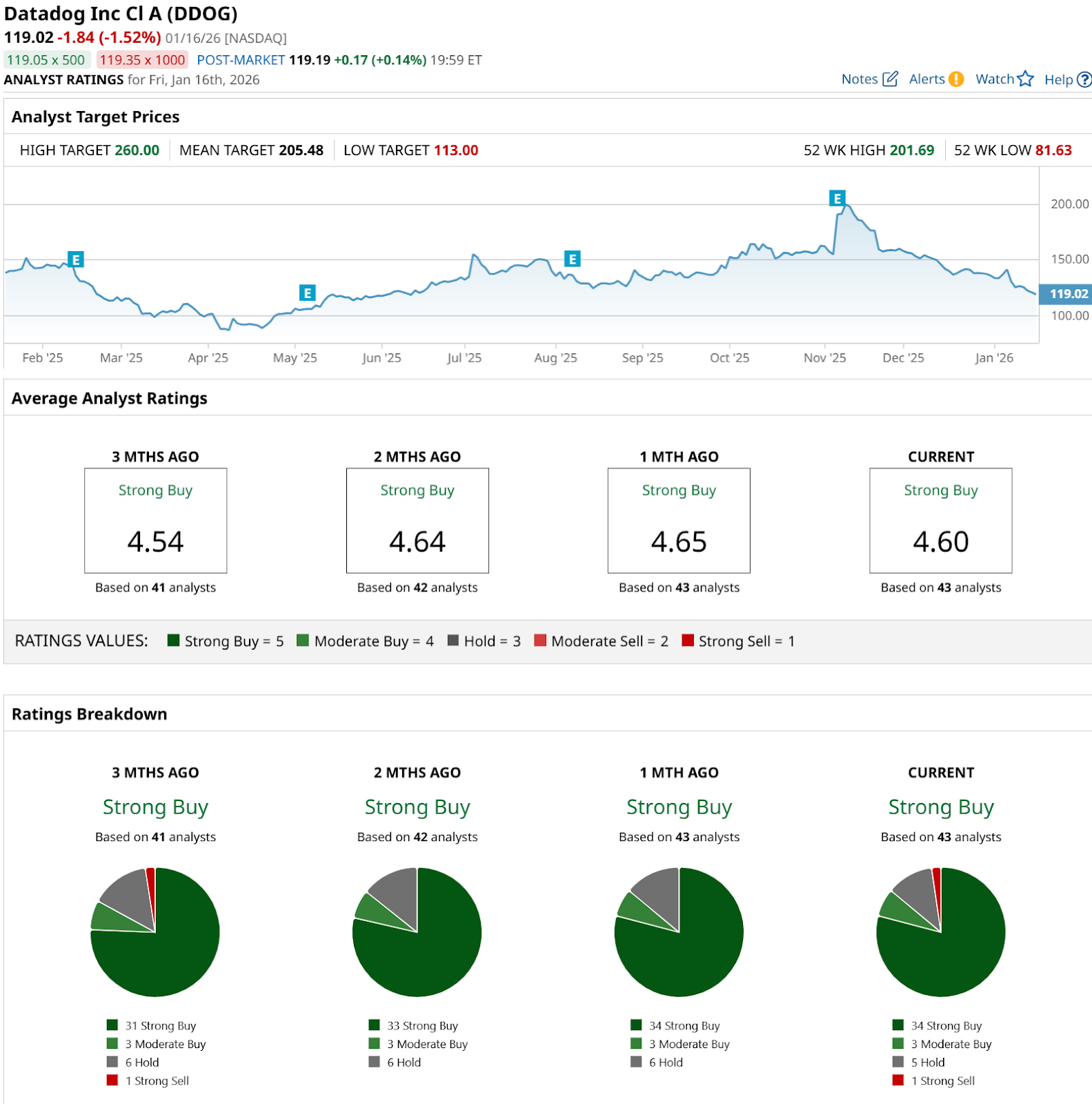

Wall Street is still bullish. The 43 analysts surveyed by Barchart rate DDOG a consensus “Strong Buy,” and the average price target is $205.48, implying about 72.64% upside from its current price of $119.02.

Fastly (FSLY)

Fastly runs an edge cloud platform that helps customers deliver and secure digital experiences closer to end users.

FSLY is down 5% over the past 52 weeks and down 14% YTD, which shows investors are still cautious even with some improvement in the business.

Valuation is also a sticking point. The stock trades at a forward P/E of about 164x versus about 25.5x for the sector. Fastly posted solid operating progress in Q3 2025, with record revenue of $158.2 million, up 15% YoY.

Security revenue was a key driver at $34.0 million, up 30%, and results also improved on the cash side with $28.9 million in operating cash flow and $18.1 million of positive free cash flow. GAAP net loss narrowed to $29.5 million, while non-GAAP profitability strengthened, with non-GAAP net income of $11.1 million.

On the product side, Fastly is trying to sharpen its security pitch by adding “Attack Insights” to its DDoS Protection, giving teams real-time visibility into attacks and mitigation actions. It also launched the Fastly Certified Services Partner Program to help partners deliver and manage Fastly’s security solutions for customers.

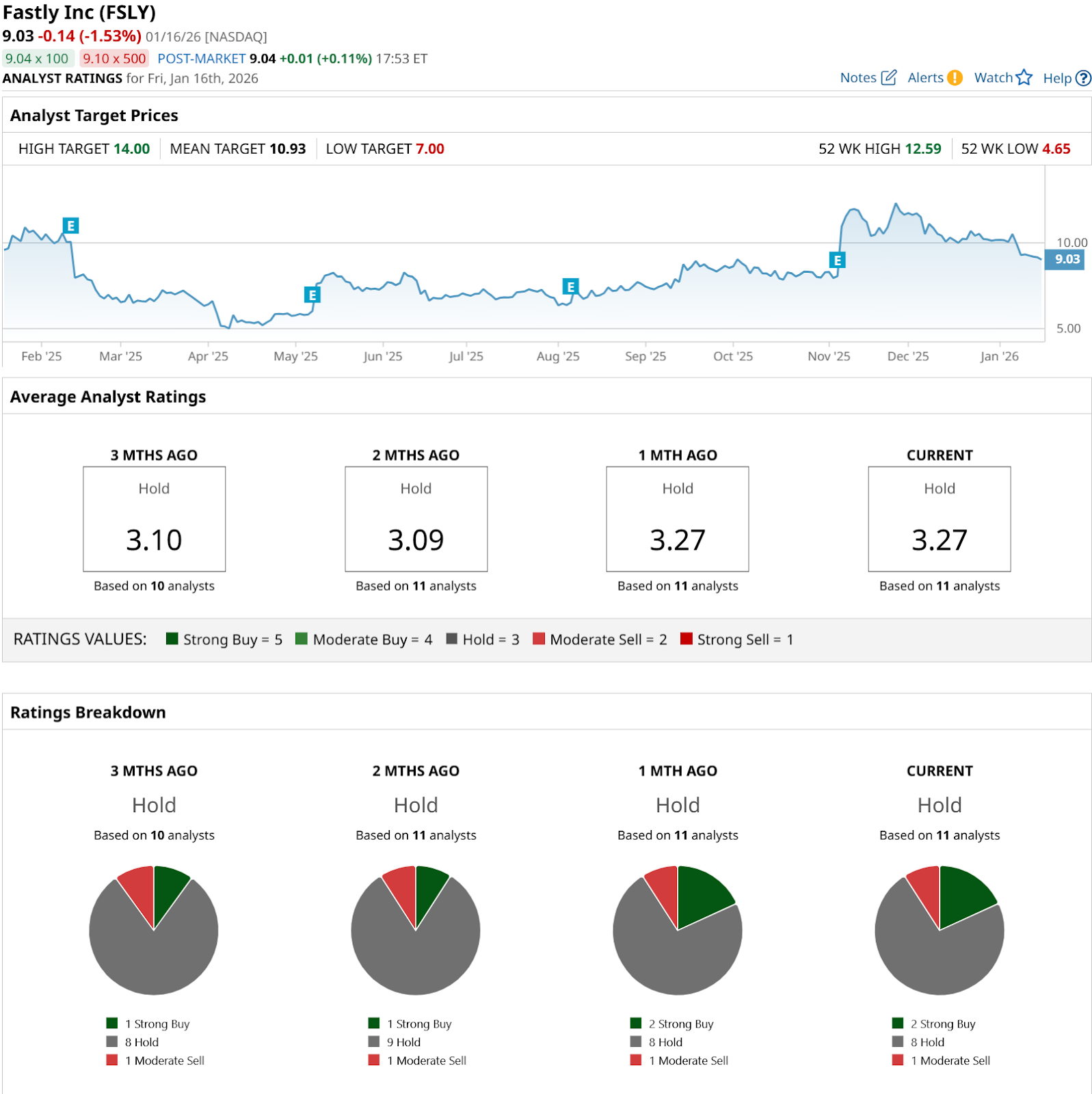

The 11 analysts rate FSLY a consensus “Hold,” and the average price target is $10.93, implying about 21.04% upside from the current price.

Atlassian (TEAM)

Atlassian sells subscription software that many teams rely on to plan, track, and share work. Jira is used for planning and tracking tasks, Confluence is used for knowledge management, and the company also sells related tools meant to connect day-to-day work across the enterprise.

The stock is down 54% over the past 52 weeks and down 28% YTD alone.

TEAM trades at a forward P/E of around 407x versus roughly 25.5x for the sector, which means the market is still pricing in standout growth for a company that is not profitable.

On results, Atlassian reported Q1 fiscal 2026 revenue of $1.4326 billion, up 21% YoY. At the same time, GAAP operating loss widened to $96.3 million, a 7% margin, partly due to $55.7 million in restructuring charges. Net loss improved to $51.9 million, and cash plus marketable securities totaled $2.8 billion.

On strategy, Atlassian is trying to stay ahead of how AI is reshaping work software. It completed the acquisition of DX to add engineering intelligence aimed at helping enterprises measure developer experience and “understand their AI investments,” and it also completed the acquisition of The Browser Company (Dia/Arc) to “reimagine the browser for knowledge work” in an AI-heavy SaaS world.

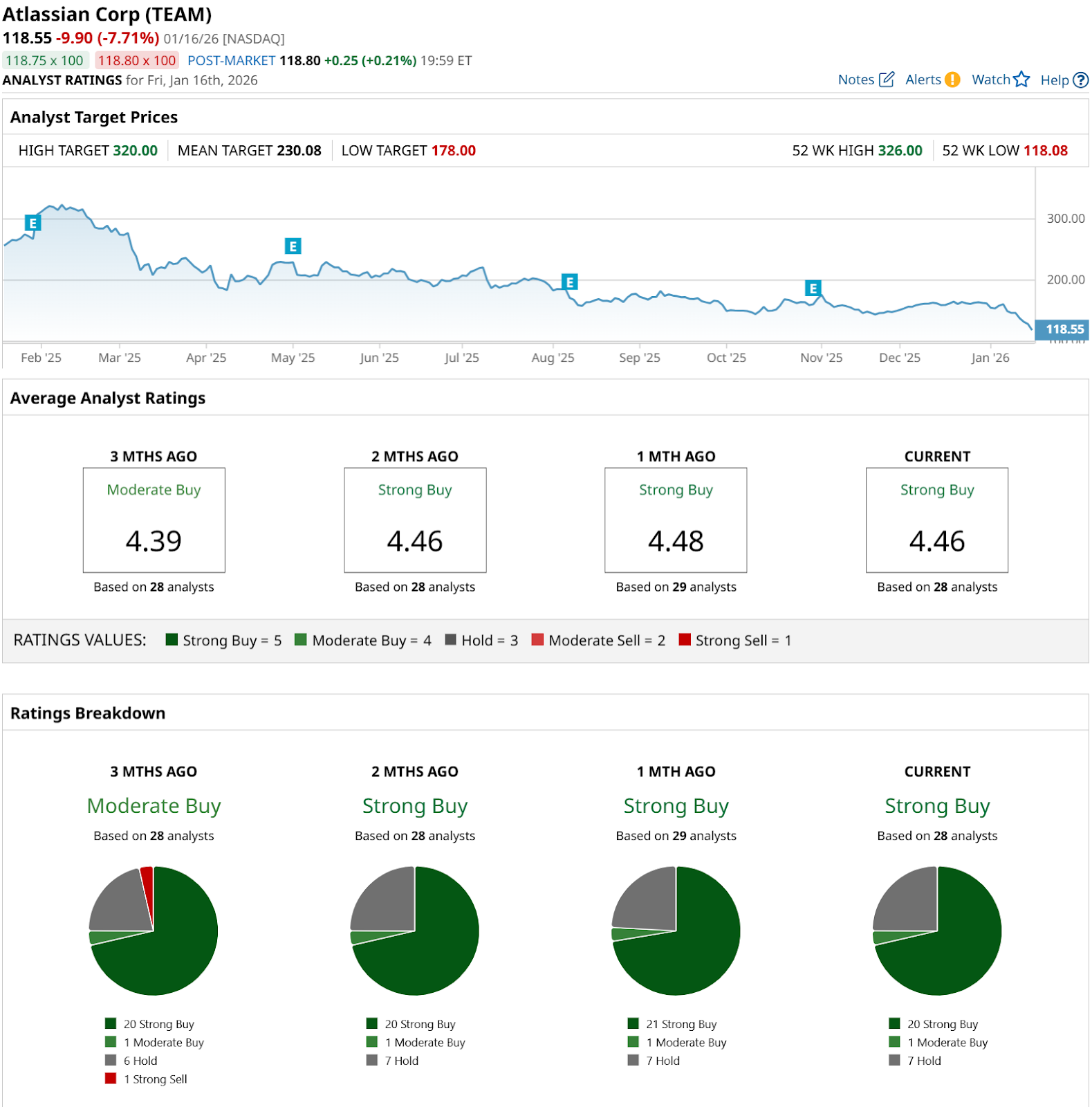

Analysts are still positive. All 28 rate TEAM a consensus “Strong Buy,” and the average target is $230.08, implying about 94.08% upside.

Conclusion

AI is not about to erase software companies overnight, but it is already reshaping where the profits accrue, and DDOG, FSLY, and TEAM all sit in the muddy middle of that transition. Each has real products, real customers, and real growth, but also premium valuations and business models that look increasingly exposed as AI-native tools and cloud platforms bake in more automation at lower incremental costs. Over the next couple of years, the path of least resistance for these shares is probably sideways to lower with sharp rallies on good quarters rather than a smooth grind higher, which tilts the risk-reward toward trimming or exiting before AI finishes rewriting the software pecking order.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- TSLA Stock Falls 3% as Musk Spats with Ryanair CEO Michael O’Leary. How Should You Play Tesla Here?

- ‘I’m Also Very Nervous’ TSMC CEO C.C. Wei says on AI Demand. Here’s the $56 Billion ‘Disaster’ Taiwan Semi Wants to Avoid in 2026.

- 3 Software Stocks to Sell Before AI Replaces Them Entirely

- Up 17% in Just 5 Days: Is a Simple Name Change Really Driving This Stock’s Surge?